Seniors who have one of the abovementioned statuses receive a monthly amount of 1764.69 $. Is this enough to support someone living in a private residence? While the prices of residential rents are rising, our seniors lack the financial resources to live a decent life and receive the care the need. Let’s take a look at what this amount includes.

Canada’s Old Age Security Program

This program was designed to guarantee a minimum income for retired seniors, whether they had worked or not. The pension allocated from Old Age Security (OAS) is not determined by employment history or income. Even if you have never worked, you can still receive an Old Age Security pension.

To be eligible for Old Age Security, you must:

- Be 65 years of age or older;

- Have resided in Canada for 40 years, after the age of 18;

- Have a Canadian citizenship.

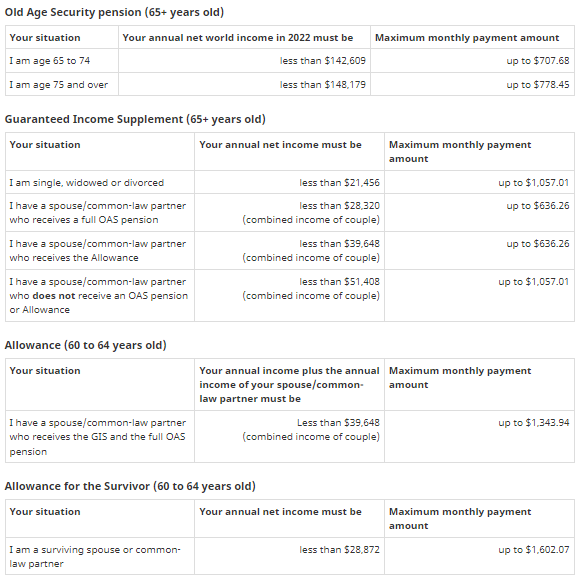

Regardless of your marital status, you are eligible for the monthly amount of $707.68.

* Note that this amount is taxable, and no pension is paid when net income exceeds $142,609.

Guaranteed Income Supplement

To be eligible for the Guaranteed Income Supplement (GIS), you must meet the following 3 criteria:

- Be 65 years old an older

- Receive an Old Age Security pension

- Have an annual income below the maximum threshold set for the year which is $21 456 for 2023 (the amount of the OAS is not included in the annual income).

* Note that this amount is not taxable, and no pension is paid if the maximum annual income exceeds the amounts indicated.

If you are single, divorced or widowed, you could receive a monthly amount of $1,057.01.

By combining the amount of the Old Age Security pension ($707.68) and the Guaranteed Income Supplement for a single, divorced or widowed person ($1,057.01), you reach an amount of $1,764.69. This is the amount you will receive from the federal government if you have one of the abovementioned statuses.

Involuntary separation

If you and your spouse were separated for reasons beyond your control, Revenue Canada has the “Involuntary Separation” measure. This will ensure that you and your spouse are considered as single for these purposes.

The Guaranteed Income Supplement is then calculated based on your income, instead of a couple’s income. To be eligible, you must have stopped living with your spouse solely for medical or economic reasons (if, for example, your spouse is living in a CHSLD).

Please inform Service Canada of your situation, as it will affect the amount of your benefits. To take advantage of this measure, you will have to complete the “Statement – Spouses living apart for reasons beyond their control”.

Allowance for the Survivor

The Allowance for the Survivor is available to people living in Canada who have low income and whose spouse or common-law partner has died.

You are eligible for the Allowance for the Survivor if you meet all the following requirements:

- You are between the ages of 60 and 64 (including the month of your 65th birthday)

- You are a Canadian citizen or legal resident

- You live in Canada and have lived there for at least 10 years after the age of 18

- Your spouse or common-law partner has died, and you didn’t remarry or live in a common-law relationship

- Your annual income is below the maximum annual threshold of $28,872.

The maximum amount you could receive is $1 581.51.

The following is a summary of monthly payments and maximum annual income from October to December 2023 for Old Age Security pension and benefits:

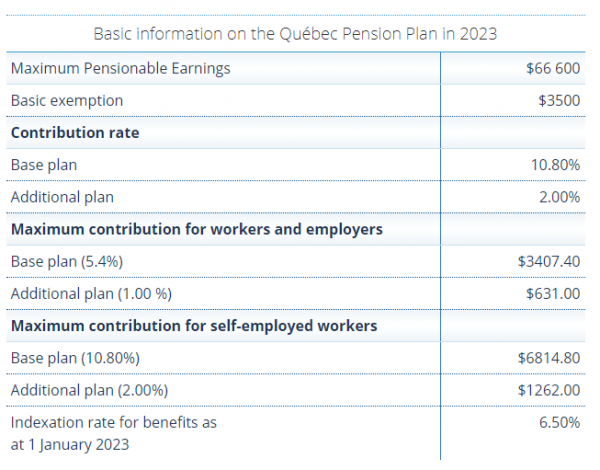

The Québec Pension Plan Retirement Pension

The Québec Pension Plan (QPP) is a public insurance plan. Contributions to the plan are mandatory for all workers aged 18 and over for whom annual income exceeds $3,500.

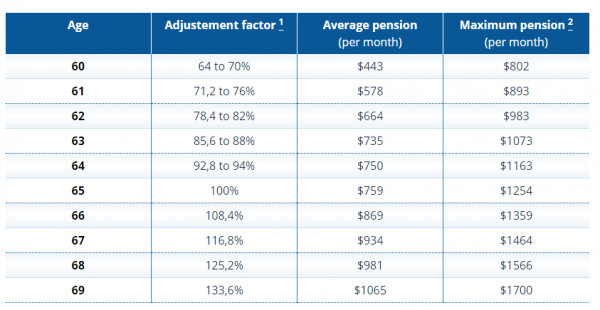

The amount of pension you receive is based on your working income since 1966. It is part of the basic income that a 60-year-old retiree can receive if he or she has contributed to the plan. Note that you can receive your pension as early as age 60. However, the amount received will be less than if you receive your pension at age 65.

At age 60, the maximum pension is $802.33

At age 65, the maximum pension is $1,253.58.

* Note that this pension is taxable, and no amount is paid if you never contributed to the Québec pension plan.

The maximum pensionable earnings in 2013 is $66,600.

The amount of pension received depends on 3 criteria:

- The age at which you retire

- The number of years you contributed to the Québec Pension Plan

- The contribution amount deducted from your working income

These two tables summarize the basic data and maximum pension amounts paid:

Table taken from Retraite Québec: The Québec Pension Plan at a glance

Table taken from Retraite Québec: The amount of your retirement pension

Sources: Revenu Québec, Retraite Québec and Service Canada

Need help?

Contact a residence advisor to help you in your search for a residence

844 422-2555

Service free of charge for beneficiaries

Member of ACHQ

Need help?

Contact a qualified residence advisor for help with your search and accompany you until the signing of your lease for FREE.

Our assistance service for the elderly is FREE*

844 422-2555

* Our residence advisors are paid by the network of private residences in Quebec certified by the Ministry of Health and Social Services.